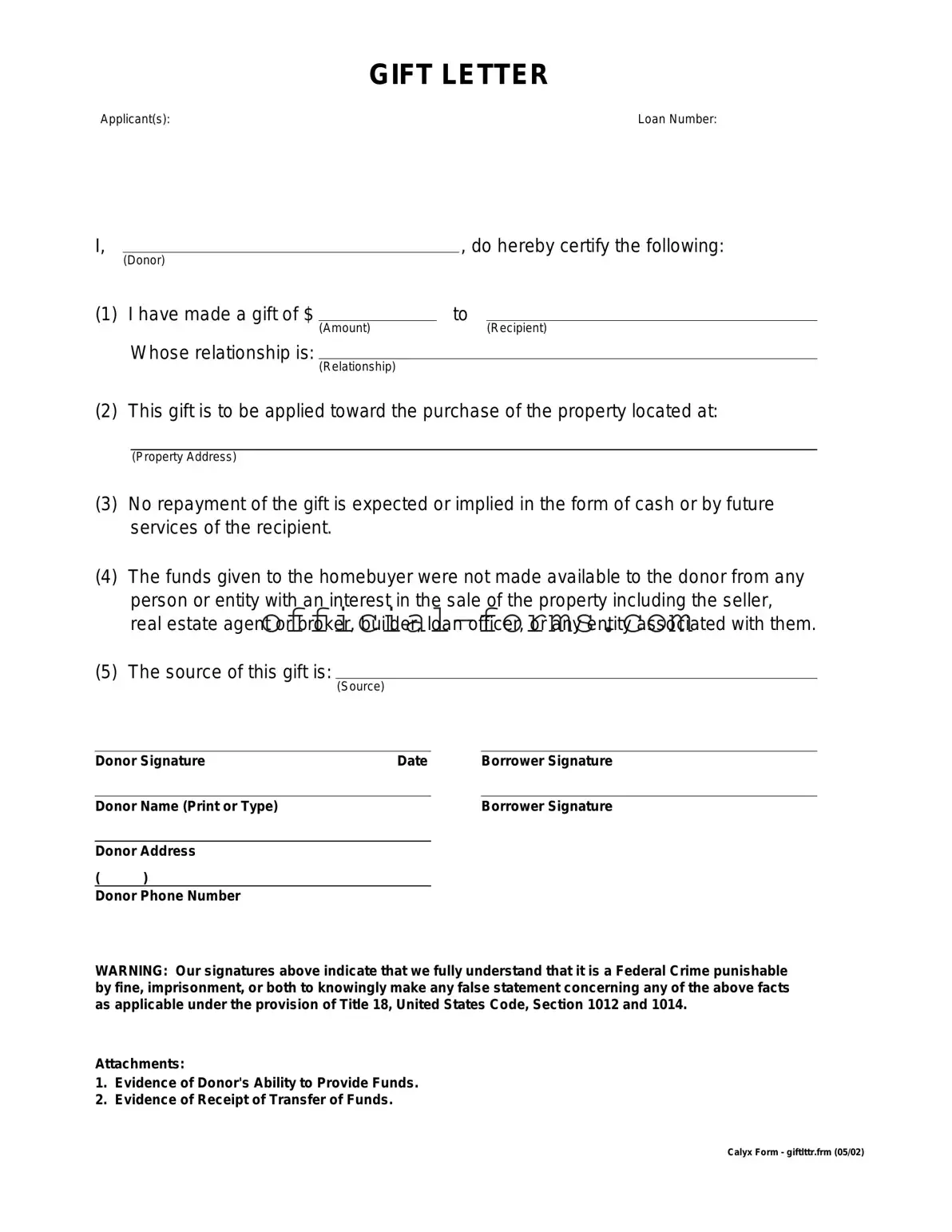

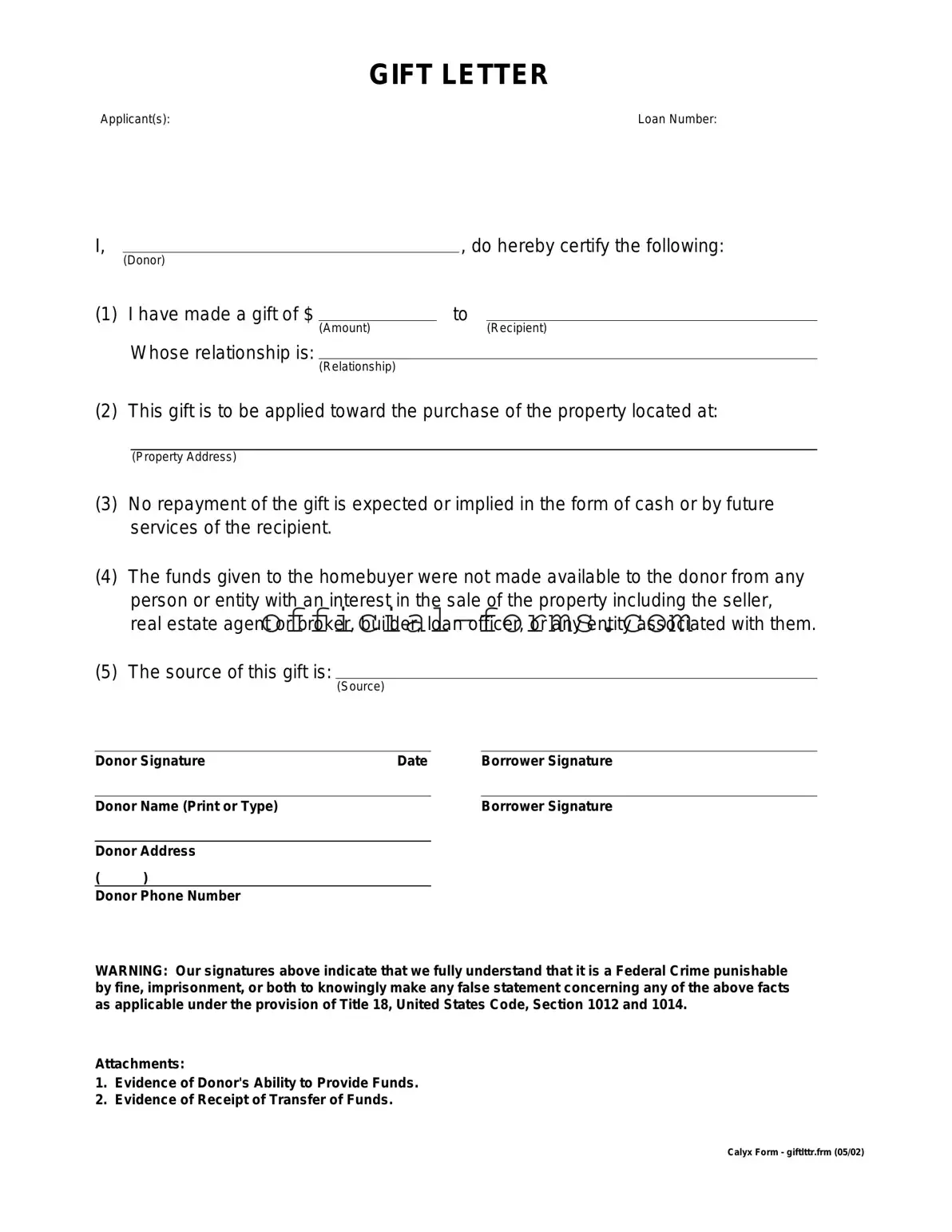

Blank Gift Letter Form

The Gift Letter form is a document used to confirm that a financial gift has been given to an individual, typically for the purpose of assisting with a home purchase. This form helps clarify that the funds are not a loan and do not need to be repaid, ensuring transparency in financial transactions. Understanding the importance of this form can make a significant difference in the home buying process.

Open My Gift Letter Now

Blank Gift Letter Form

Open My Gift Letter Now

Don’t leave your form incomplete

Finish Gift Letter online quickly from start to download.

Open My Gift Letter Now

or

➤ PDF