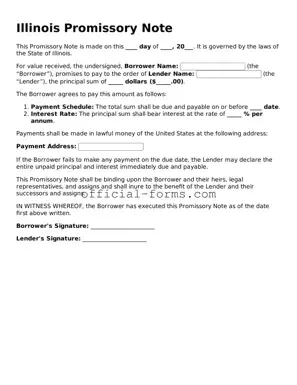

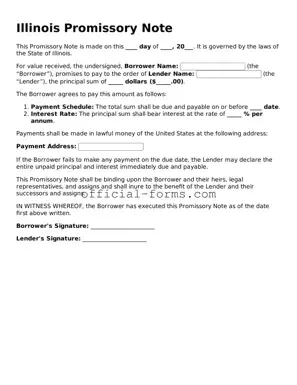

A Promissory Note is a written promise to pay a specified amount of money to a designated party at a defined time. In Illinois, this form serves as a crucial tool for individuals and businesses alike, facilitating clear agreements regarding...

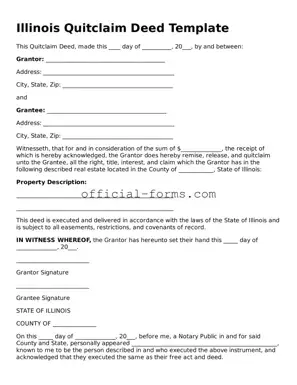

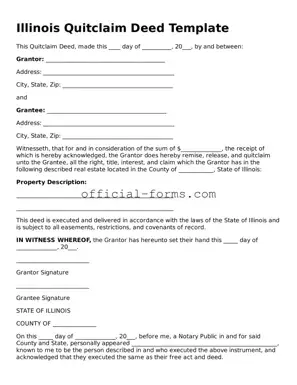

A Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another party without making any guarantees about the title. This form is commonly used in Illinois to simplify the transfer...

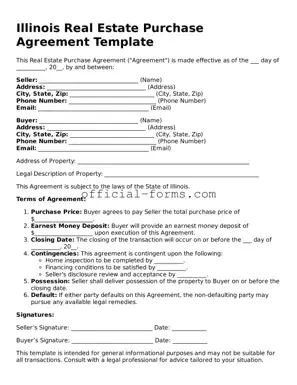

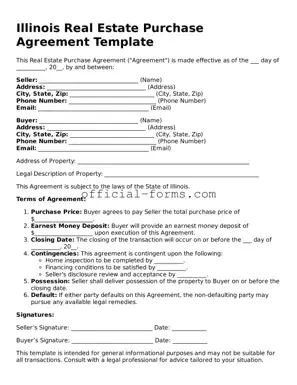

The Illinois Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase real estate from a seller. This form serves as a binding contract that protects the interests of...

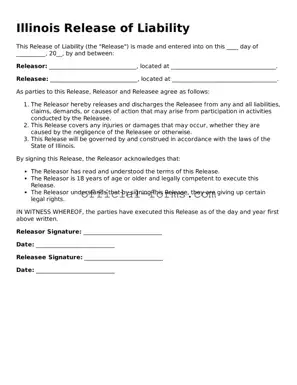

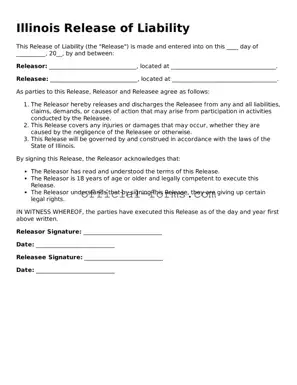

The Illinois Release of Liability form is a legal document designed to protect individuals and organizations from claims resulting from injuries or damages that may occur during specific activities. By signing this form, participants acknowledge the risks involved and agree...

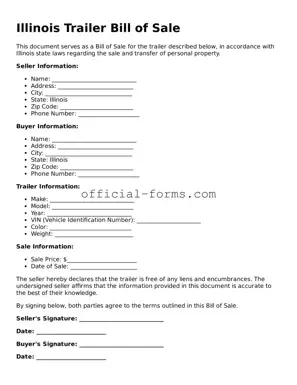

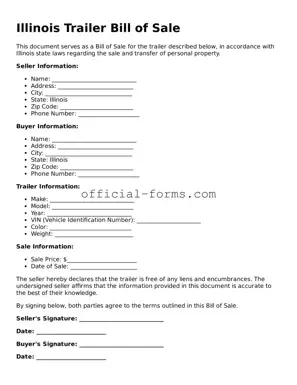

The Illinois Trailer Bill of Sale form is a legal document used to transfer ownership of a trailer from one party to another. This form serves as proof of the transaction and includes essential details about the trailer, such as...

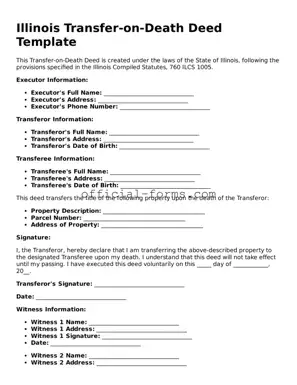

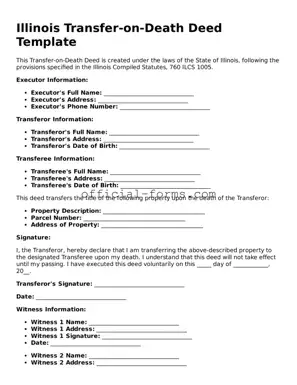

The Illinois Transfer-on-Death Deed form allows property owners to designate beneficiaries who will receive their real estate upon their death, without the need for probate. This simple yet effective tool can streamline the transfer process, ensuring that your wishes are...

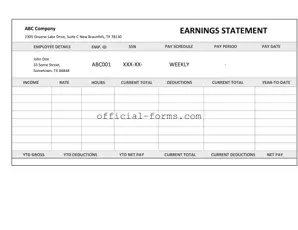

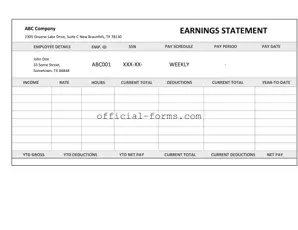

The Independent Contractor Pay Stub form is a document that outlines the earnings and deductions for independent contractors. This form serves as a record of payment and provides essential details about the services rendered. Understanding this form is crucial for...

An Investment Letter of Intent (LOI) is a document that outlines the preliminary terms and conditions of a potential investment agreement. It serves as a starting point for negotiations between parties and helps clarify intentions before formal contracts are drafted....

The IRS 941 form is a quarterly tax return that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This essential document helps the Internal Revenue Service keep track of payroll taxes owed...

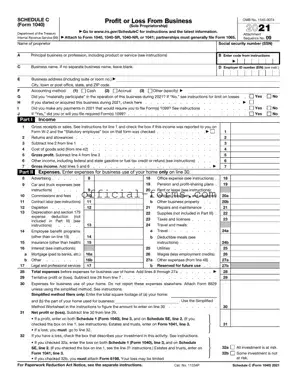

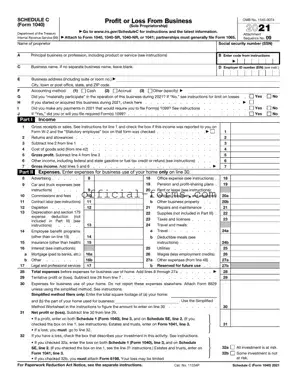

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business. This form provides a detailed account of business expenses and helps determine the net profit or loss for...

The IRS W-2 form is a crucial document that employers must provide to their employees, detailing wages earned and taxes withheld during the year. This form plays a significant role in the tax filing process, ensuring that individuals accurately report...

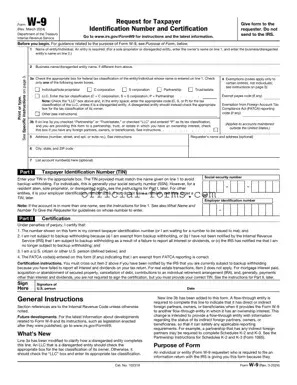

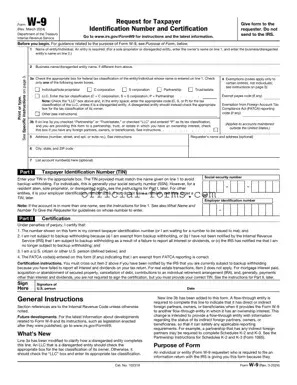

The IRS W-9 form is a document used by individuals and businesses to provide their taxpayer identification information to other parties. This form is essential for reporting income to the IRS, ensuring that the correct amount of taxes is paid....